Cookie Settings

Please allow us to collect data about how you use our website. We will use it to improve our website, make your browsing experience and our business decisions better. Learn more

Bitcoin has been holding steady at $90,258 to $90,509 over the last hour and indicators suggest a continuation of positive momentum, though minor pullbacks across timeframes hint at chances for strategic moves.

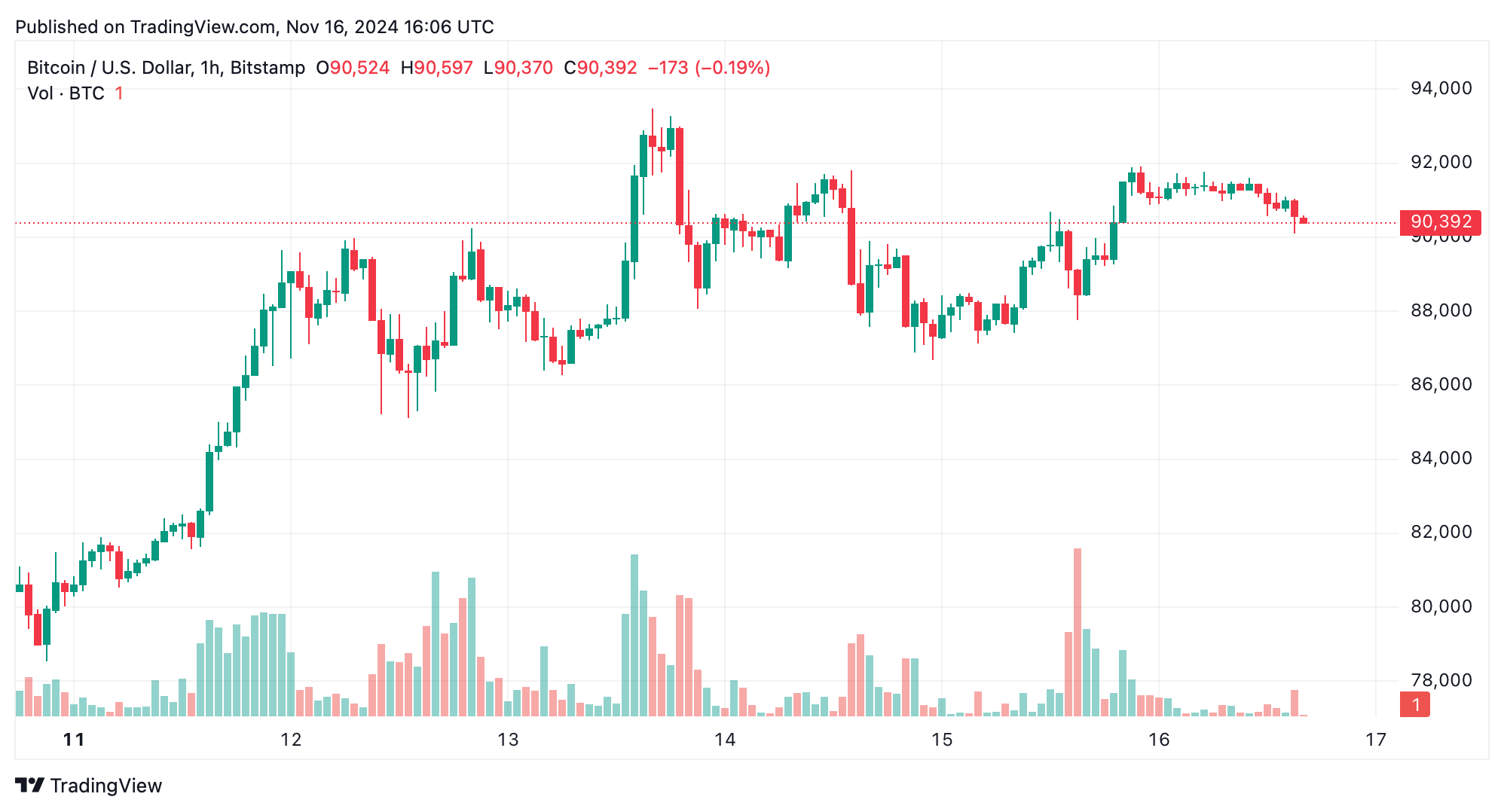

Bitcoin‘s hourly chart showcases a recent climb to $91,909, followed by a slight dip. Recent drops signal bearish movement, but the decline appears shallow, suggesting sellers might be running out of steam. With support holding around $91,000 and $90,000, and resistance sitting near $92,000, these levels are key to watch. Trading volume this weekend has dipped since the rally, signaling caution. A bounce near $91,000 could create an opportunity for a long trade targeting $92,000 or beyond.

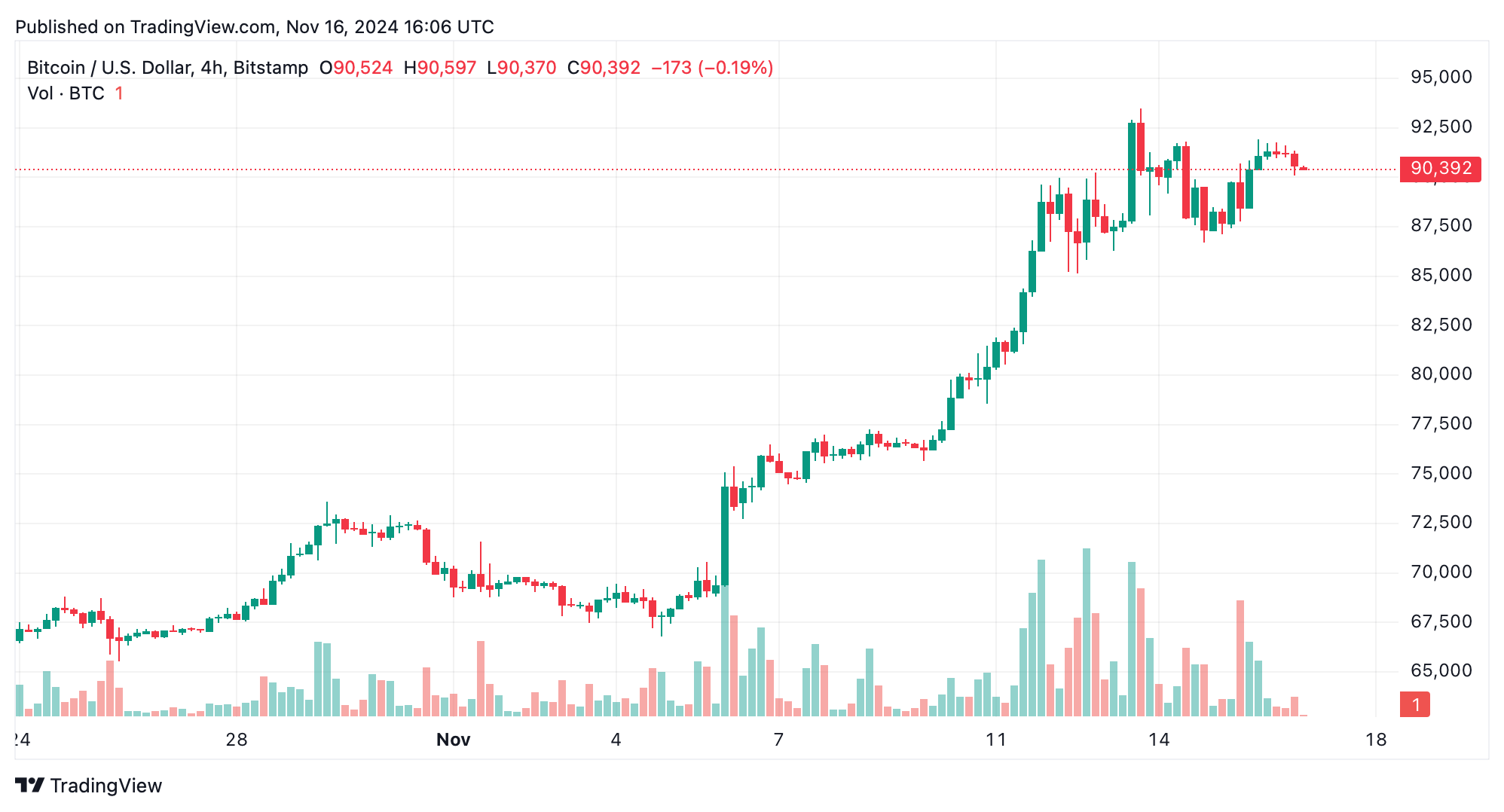

Zooming out to the 4-hour chart, the uptrend remains intact with a high of $93,483. While lower highs are forming, the pattern of higher lows sustains a positive outlook. Support at $90,000 and $88,000 offers attractive entry points, while resistance at $93,500 is the next major test. The recent drop in trading volume post-rally suggests a pause in the action, providing medium-term traders a chance to position themselves around $90,000 with tight stop-losses below $88,000. A breakout beyond $93,500 could pave the way for further gains.

On the daily timeframe, bitcoin’s rally from $62,039 to $93,483 underlines a strong trend. The dip back to current levels aligns with natural trend behavior. Significant trading volume during the rally highlights market interest, but the current tapering indicates possible consolidation. Support at $85,000 serves as a safety net, while resistance at $93,500 and $95,000 offers targets for those looking to lock in profits. A sustained move above $90,000 could build momentum for a push toward $95,000.